Tax Reduction

Tax Reduction Questions sound like…

- Am I paying too much in taxes?

- How do my investment decisions affect my tax bill?

- When will tax rates go up?

- Should I convert my IRA to Roth?

WILL I HAVE ENOUGH TO DO THE THINGS MOST IMPORTANT TO ME?

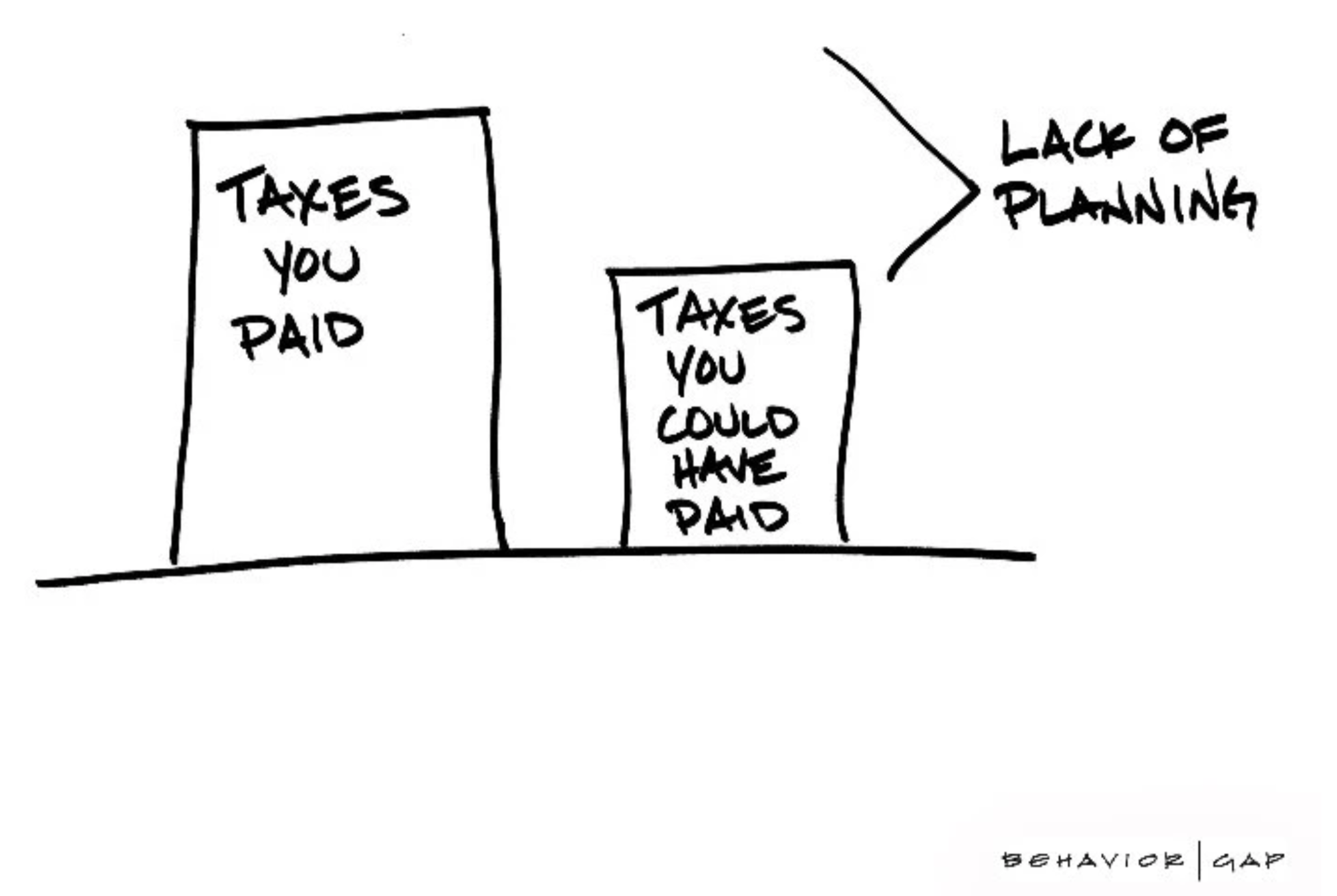

It’s Okay to Pay Tax. Just No More Than You Need to

Taxes are one of the biggest expenses of your lifetime.

Unfortunately, most people don’t take advantage of the many incentives the Government gives us access to, so they end up paying more than they have to.

The good news is, your income plan and investment plan can work hand in hand with your tax plan to lower the amount of taxes that you’ll pay in the future.

It all starts with our Streamlined Process (our proprietary planning service).

Click here to get your free planning session.

You don’t have to prepare anything. We’ll just ask you really good questions.

Increase Your Cash Flow

It’s not just what you make, it’s what you keep.

A good way to increase your cash flow is by paying less in taxes this year.

And tax efficient investments are one way to do just that.

It’s a Long Game

When people think about tax planning, they think about what they can do this year.

But in reality, we see it as a long game.

- Where are tax rates going?

- What will income look like for you in the future?

- What’s your giving plan?

- When will we use certain investments?

Questions like this come to mind as we’re planning the next 10-20 years of your taxes.

And they help guide us as we’re designing your plan with minimal taxation in mind.

Your Money Can Go to Four Places:

- You

- Your family

- Charities

- The Government

Deciding ahead of time where you’d like your money to go is the first step to proper tax planning.

Withdrawal Strategies Combined with Tax Planning

One of the biggest impacts on how much tax you pay over your lifetime is the withdrawal strategy you decide to implement.

In our tax planning meetings, we’ll be able to go over the various options you have and how it affects the amount of tax you’ll pay.

.png)